Please set subtitles on Youtube to English.

The hypothesis in this article is based on the following data:

The mortgage reference interest rate and the calculation of rents

When mortgage interest rates rise, the reference interest rate used to calculate rents is subsequently adjusted. It is published by the Federal Office of Housing four times a year and corresponds to the average interest rate for Swiss franc-denominated mortgages held by banks in Switzerland.

According to Art. 13 of the Ordinance on Rent and Lease, a 0.25% increase in the mortgage reference rate entitles the tenant to a rent increase of 3% if the mortgage interest rate is below 5%. This calculation must be made if the rent was previously calculated using the relative method.

According to Art. 269 d of the Code of Obligations, the notice of the rent increase with reasons must be served on the tenant at least 10 days before the start of the notice period. The landlord must therefore first check which is the next expiration date of the lease and calculate the date by which he must serve the increase on the tenant at the latest. Some leases, especially for commercial premises, are for several years, which can have financial disadvantages for the landlord as he has to wait for the lease to expire.

If an owner has a mortgage and interest rates rise, the return on the property goes down. If he does not or cannot increase the rent, the yield drops even further. If previous changes in the mortgage rate, especially decreases, have not led to a change in the rent, an increase due to a rise in the mortgage rate is not allowed.

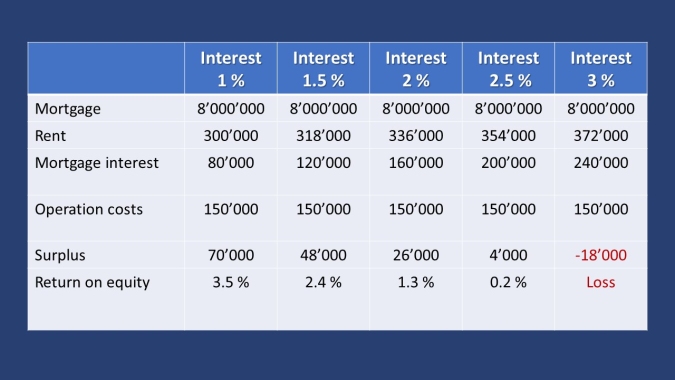

Example

Value of the property (pledge value, purchase price): CHF 10'000'000

Equity CHF 2,000,000 (20 %)

Mortgage CHF 8,000,000 (80 %)

This table serves as an illustration to explain the effects of mortgage interest rate increases on the yield. Each property is financed differently and this calculation must be done with the actual figures. Half a per cent increase in the mortgage rate is equivalent to interest of CHF 120,000, so the owner has to pay CHF 40,000 more. He can later, when the mortgage interest rate increases are reflected in the mortgage reference rate for calculating rents, increase the rents from CHF 300'000 to CHF 318'000 (increase of 2 x 3 % = 6 %). The difference between CHF 40'000 and CHF 18'000, i.e. CHF 12'000, is entirely at the owner's expense. In this table I have set the cost of the building at CHF 150'000 to calculate the return on equity. In this example, you can see that the owner will suffer a loss on the equity if the mortgage rate rises to 3%, even if he increases the rents. I remind you that the mortgage rate has averaged 4 to 4.5% over the last century.

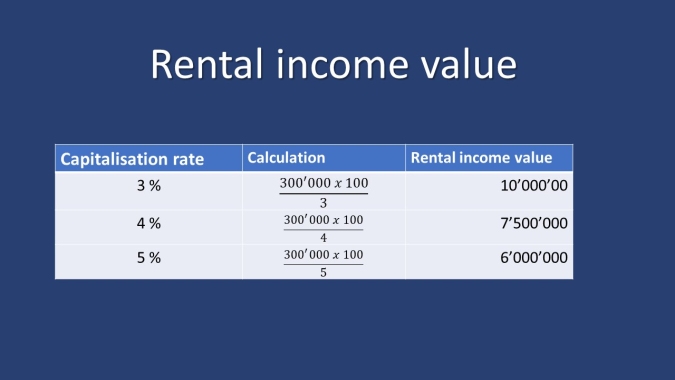

The value of income properties

In the appraisal of real estate, mortgage rates are used to set the capitalisation rates to calculate the income value and to make calculations using the discounted cash flow (DCF) method. Higher mortgage rates and long-term interest rates result in a lower value of the property.

Example for the calculation of the income value

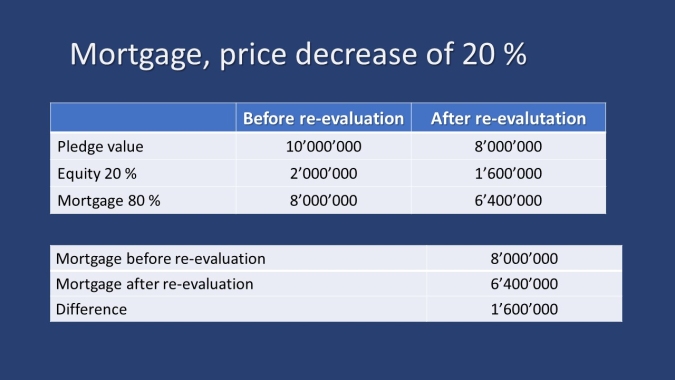

Impacts on equity when the property's mortgage lending value decreases

The mortgage lending value is the value of the property estimated by the bank at the time the property was financed. In the bear market, properties are revalued by mortgage lenders and the missing equity must be replenished.

Example:

Decrease of the pledge value by 20%.

In our example, the pledge value falls from CHF 10,000,000 to CHF 8,000,000. The mortgage debt of CHF 8,000,000 must be reduced to CHF 6,400,000. The difference of CHF 1,600,000 must be paid back to the bank. The owner also loses CHF 400'000 on the equity.

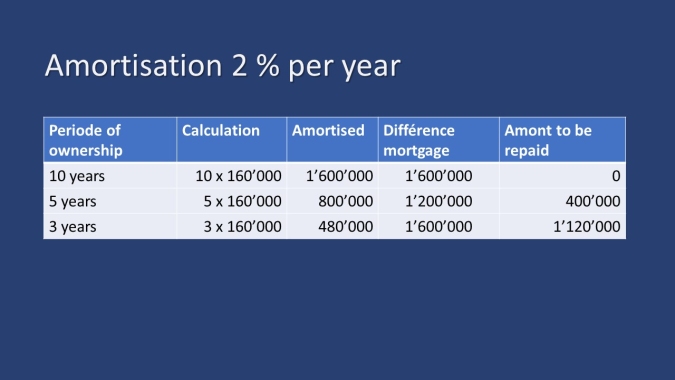

If an amortisation of 2% per year was agreed, it is possible that the difference has already been repaid. In this example, if an annual amortisation of 2 % was agreed and the property was financed 10 years ago, the bank has already collected the difference of CHF 1,600,000. Assuming that the property was financed 3 years before the 20% reduction in the deposit value, the owner will have to repay CHF 1,120,000.

Conclusion

When mortgage and long-term interest rates rise, investors look for more profitable alternatives.

For owners who have financed their properties with 100% equity, the return increases because the right to increase the rent is not conditional on the owner having taken out a mortgage.

Investors who bought their properties just before their value declined with little equity and at low yields and took advantage of the leverage effect will see their yields melt and possibly lose money. Also read my article and watch the video on yield calculations and the leverage effect.

Tenants should expect rent increases. They can challenge rent increases and landlords can expect further legal challenges.

© Written by Esther Lauber, Property Fiduciary with Federal Diploma of Higher Vocational Education and Training, real estate agent, property broker and manager in Carouge Geneva, translated with www.DeepL.com/Translator (free version)

More information with video that may be of interest to you

The cost of buying a property