According to the Geneva law of registration fees, also known Casatax, the purchaser of a unit located in the canton of Geneva can benefit from the reduction in registrations fees.

The conditions to be met by the beneficiary

- Housing is intended as a principal residence to the purchaser

- The beneficiary must, up to 2 years after the registration of the deed of purchase, give the goverment the proof of the assignment of the property as his principal residence

- From that moment, the purchaser must occupy his property for a continuous period of 3 years. Otherwise the uncollected ballance of rights is due, with the exception if the beneficiary died

Link electronic form for declaration of assignement of the property as your principal residence: https://bit.ly/2Sd0GEL

The conditions and reductions in 2026

- The transaction value dos not exceed CHF 1'394'928. This vallue is indexed annually to the Geneva construction index and adapted to the 1st of March (index 2025: 113,8 points)

- The sales taxe is reduced by CHF 20'924

- Registration fees on mortgage deeds are halve

For purchase off plan

If the residential property has not yet been built, the transaction value includes the purchase price plus all services resulting from the construction contract. The registration fee for the general contractor agreement cannot be reduced.

Purchase by several persons

If several persons purchase their main residence in joint ownership or co-ownership, the registration fees are reduced according to the shares of the individual persons.

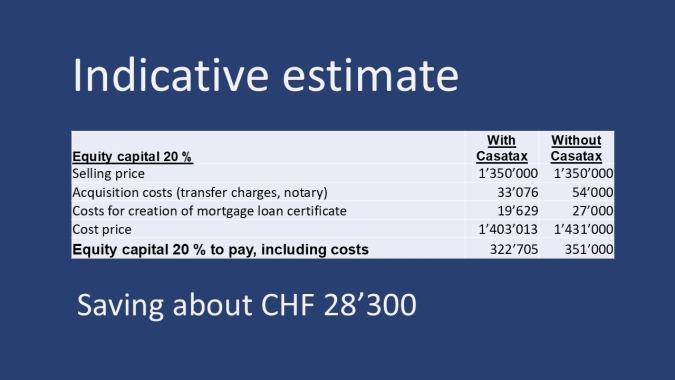

Example calculation 2026:

© Esther Lauber, Property Fiduciary with Federal Diploma of Higher Vocational Education and Training, property manager and broker

More information that may be of interest to you:

Calculate your budget for the purchase of your principal home

Financing real estate in Switzerland

The cost of buying a property in Geneva